BRIDGING THE GAP

GEOPOLITICS IS RUSSIA-UKRAINE ANY DIFFERENT?

GEOPOLITICS

IS RUSSIA-UKRAINE ANY DIFFERENT?

February 14, 2022

Geopolitical events often follow a standard blueprint. The event consumes the headlines. Investors show some panic, causing a period of market volatility. And, finally — so long as fundamentals are not broadly impacted — financial markets go back to what they were focusing on prior to the fire alarm. Currently, that’s inflation and the central bank reaction function. Our monthly Perspective Newsletter details broader asset allocation (no changes were made this month); while this short note provides specific thoughts on Russia-Ukraine.

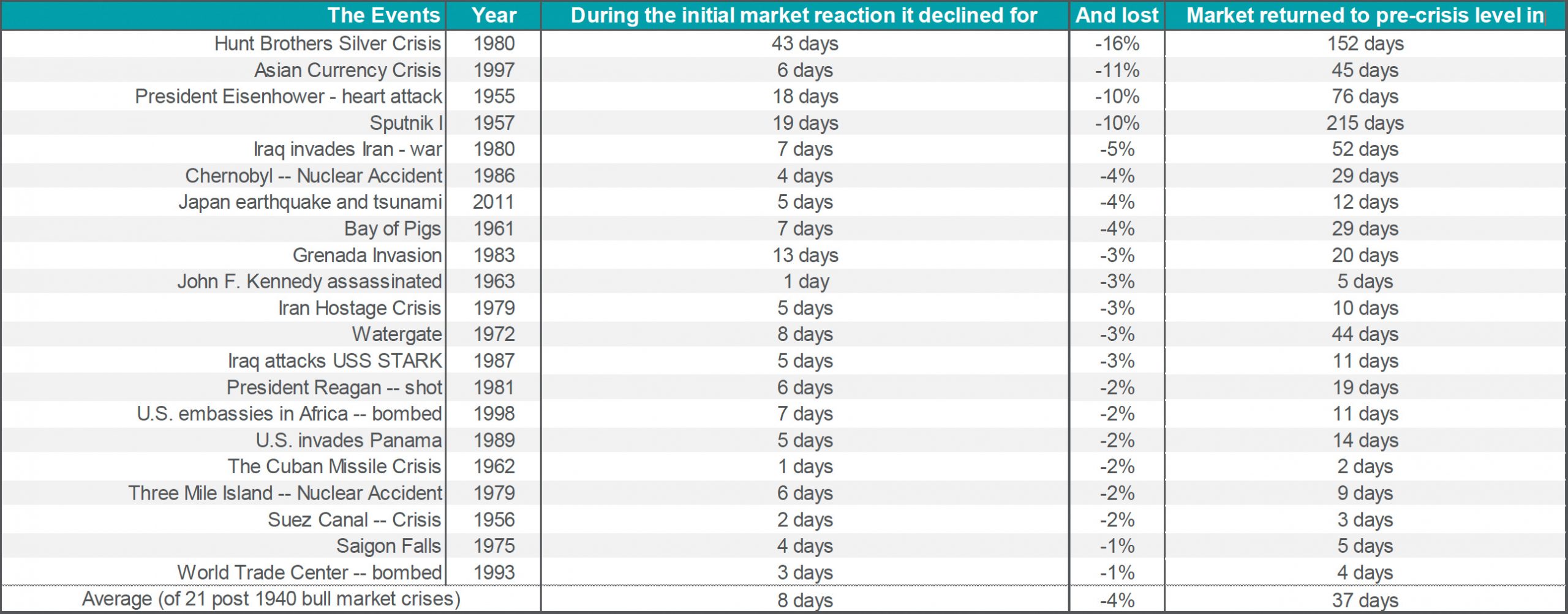

Exhibit 1 shows a number of geopolitical events over the years and how financial markets responded — both in terms of the length and size of the drawdown as well as the period of time it took to regain previous levels. On average the markets lose around 4% and make up those losses in just over a month. The current geopolitical event is occuring at the time of another pressing question for the markets — the timing and scope of Federal Reserve tightening. As such, it’s a bit difficult to disentangle the two — but, overall (driven by both), we’ve seen global (U.S.) equity markets fall by 8.6% (10.5%) at their lowest (January 27) only to rebound by 5.7% (6.6%) — and are currently down 5.2% (7.6%) year-to-date. We view this market weakness as an opportunity — with the global growth story supporting an overweight to risk, specifically in developed equities, high yield and natural resources — even in the face of current uncertainty (though, the markets are never “certain”).

EXHIBIT 1: GEOPOLITICAL EVENTS

Historically, geopolitics do not impact financial markets for long unless the market outlook fundamentally changes.

Source: Northern Trust Asset Management, Crandall, Pierce & Co

WHAT COULD HAPPEN WITH RUSSIA-UKRAINE? THREE POTENTIAL SCENARIOS

Outlining scenarios and assigning probabilities is always a useful tool with uncertain events such as geopolitical tensions and risks. Below we outline the three most likely scenarios, our best guess at each scenario’s likelihood and the impacts on the fundamental inputs of growth and inflation.

Full Invasion: Russia invades with the intention to take full control of Ukraine (10% probability).

- Growth Impact: Negative for emerging and developed Europe. Trade would be negatively impacted and, depending on the sanctions regime that gets implemented, European financial institutions run the risk of capital impairments on Russian and Ukrainian assets. Higher energy prices would also hurt economic growth, and uncertainty over energy supplies would be a headwind, too (double whammy).

- Inflation Impact: Energy prices move higher and second-round effects likely kick in.

Partial Invasion: Russia consolidates its de-facto control of the Donbass region and perhaps some other parts but does not attempt to take full control of the country. In doing so, it sends a signal to the Western World how seriously it takes its security (40% probability).

- Growth Impact: Negative but muted, and not a game changer for developed Europe depending on the sanctions regime.

- Inflation Impact: Short-term negative but could fade relatively quickly if the situation stabilizes and energy markets remain functioning.

No Invasion: Russia retreats a large part of its troops (although it is likely Russia will also maintain a very meaningful presence for longer) but gets enough diplomatic concessions that it refrains from invasion (50% probability).

- Growth Impact: Positive but muted and mostly due to lower energy prices.

- Inflation Impact: Positive through lower energy prices, which will shorten the time for headline inflation to return to target.

CONCLUSION: A PORTFOLIO DESIGNED TO ADDRESS RISKS

Investment portfolios are subject to market risks (short or longer-lived) all the time. And, as such, the first conclusion is an oft-repeated one: the portfolio’s risk aversion should mirror that of its owner. This means having an allocation to risk-control assets (cash, investment grade fixed income and inflation-linked bonds) commensurate with the amount of protection the owner wishes to have against broad downturns in equity markets (and related risk assets such as high yield, real assets and alternatives). At their best, risk-control assets gain value during risk asset downturns; at their worst (at least in the century of data we have) risk-control assets at least provide downside protection. Having the right mix of risk-control and risk assets is always the first — and most important — decision to make. Beyond that, certain asset classes (even within risk assets) are in the portfolio to provide an answer for more acute risks that arise from time to time. We believe a strategic position (and tactical overweight where appropriate) to natural resources can help navigate the current environment given the likely impact a Russian invasion would have on oil and natural gas supplies, specifically into Europe.

Northern Trust Global Asset Allocation

© 2022 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A.

IMPORTANT INFORMATION. For Asia-Pacific markets, this information is directed to institutional, professional and wholesale clients or investors only and should not be relied upon by retail clients or investors. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust and are subject to change without notice.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. Information is subject to change based on market or other conditions.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Securities offered through J.W. Cole Financial, Inc (JWC) Member FINRA/SIPC. Advisory Services offered through James River Asset Management LLC. James River Wealth Advisors and James River Asset Management LLC are unaffiliated entities of J.W. Cole Financial.

The information contained in this does not purport to be a complete description and is intended for informational purposes only. Any opinions are those of the content creator and not necessarily those of the named advisor(s), JWC or JWCA.

DISCLOSURES

The material contained in the ’Market Commentary’ is for informational purposes only and is not intended to provide specific advice or recommendations for any individual nor does it take into account the particular investment objectives, financial situation or needs of individual investors. The information provided has been derived from sources believed to be reliable, but is not guaranteed as to accuracy and does not purport to be a complete analysis of the material discussed, nor does it constitute an offer or a solicitation of an offer to buy any securities, products or services mentioned. Past performance is not indicative of future results. Diversification cannot assure profit or guarantee against loss. Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index.

Bridging where you are to where you want to be through timeless financial advice / Contact us today to get started!

James River Wealth Advisors

15521 Midlothian Turnpike, Suite 100

Midlothian, VA, 23113

Eli's Village

E: inquiry@elisvillage.com

P: (804) 302-0502

Advisory services offered through James River Asset Management, LLC. Insurance services offered through James River Wealth Advisors.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Our site contains hyperlinks to other web sites operated by third parties. These links will take you away from our site. Please note that we do not guarantee the accuracy or completeness of any information presented on these sites.